Singapore

Singapore

UnionPay Tax Refund Tips:

eTRS service is provided in Singapore. There is no need for shoppers to write any information by themselves when they purchase and claim tax refund in a store with eTRS logo.

Tax Refund Steps:

Purchase

When making purchases at merchants posted with eTRS logo, please use the same credit card to serve as the voucher for all purchases. When spending over S$100 (about 498 RMB), please get the eTRS receipts and original invoices/receipts from the merchants. If a merchant is not a member of eTRS system, ask the merchant for a Tax Refund Form and complete and sign on it. Please retain the original invoices/receipts after purchase.

Pre-departure tax refund via eTRS system/Tax Refund Form

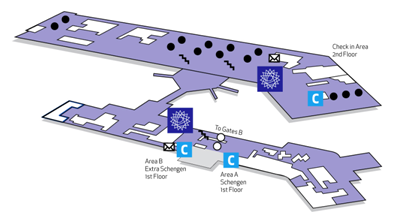

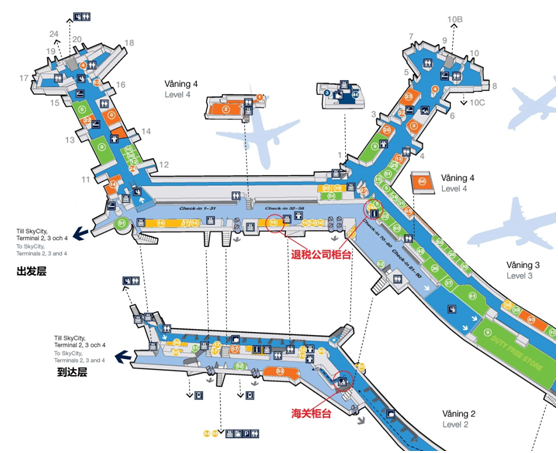

If you need to carry about any good purchased, please have it registered before heading for the Transit Lounge (behind the Departure Hall). To get the tax refund for purchased goods and services issued with eTRS receipt, please go to the eTRS self-help service counter. If you hold a Tax Refund Form, please go through the tax refund procedure at the Customs Inspection Counter.

eTRS Self-help Tax Refund

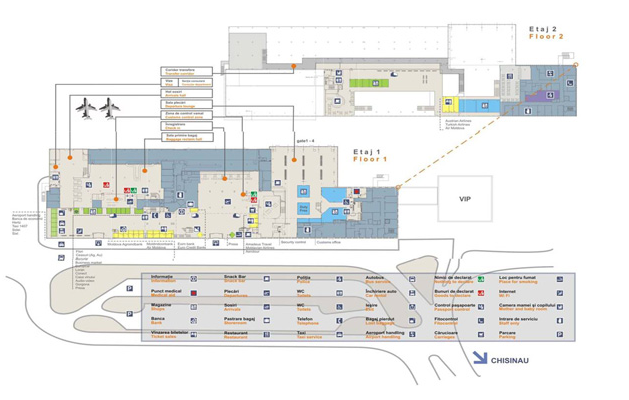

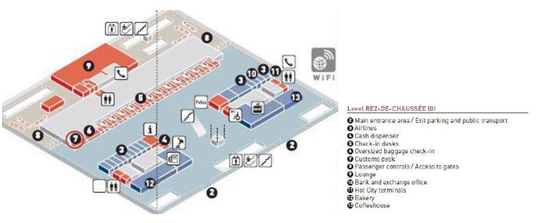

At the eTRS self-help service counter, please use the designated credit card as the voucher for retrieval of purchase details; or you can also scan your eTRS receipts to retrieve all purchases, and then apply for tax refund for goods and services according to eTRS's instructions. You may be required to present your purchased goods at the Customs Inspection Counter. The eTRS self-help service counters, located at the Departure Hall (before going through the departure procedure) and the Departure Transit Lounge in Terminal 1, 2 and 3 (after going through the departure procedure) of Changi Airport, are open throughout the day;

Tax Refund via Tax Refund Form

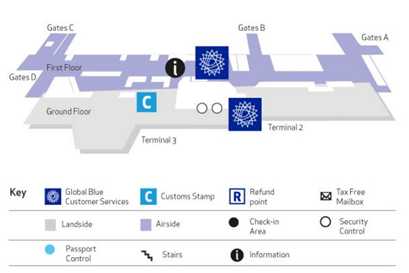

To get the tax refund by using Tax Refund Form issued by Global Blue or Global tax free, please present the Tax Refund Form to the Customs Inspection Counter for stamping and having purchased goods inspected.Note: No Customs stamp, no tax refund

Tax refund via Mobile App

Using Tourego app to claim your tax refunds app can experience the mobile app tax refund, which is faster and more convenient, and there is no need to queue up in front of the ETRS self-service machine. In addition, Tourego app supports all shopping tax returns in Singapore.

Download Tourego app to register members and bind UnionPay cards on the App. (both credit and debit cards are supported);

Download Tourego app to register members and bind UnionPay cards on the App. (both credit and debit cards are supported);

When fulfilling the quality of tax refund application, open Tourego app and show QR code to the merchants;

When fulfilling the quality of tax refund application, open Tourego app and show QR code to the merchants;

Before departure, open the Tourego app in the tax refund area of the airport, click "mobile phone tax refund" on the home page and operate followed by the guidance, then the refund will be refunded to the designated UnionPay card.

Before departure, open the Tourego app in the tax refund area of the airport, click "mobile phone tax refund" on the home page and operate followed by the guidance, then the refund will be refunded to the designated UnionPay card.

After returning home, you can log on Tourego app or UnionPay international official website / wechat account to check the progress of tax rebate.

After returning home, you can log on Tourego app or UnionPay international official website / wechat account to check the progress of tax rebate.

Claim the refunded tax:

If you select the option of credit card for receiving tax refund at eTRS Self-help counters, you can get on board directly without going through any procedure;

If you select the option of credit card for receiving tax refund at eTRS Self-help counters, you can get on board directly without going through any procedure;

If you choose to receive the tax refund in cash, please get the refunded cash at the Central Refund Counter in the Transit Lounge (behind the Departure Hall);

If you choose to receive the tax refund in cash, please get the refunded cash at the Central Refund Counter in the Transit Lounge (behind the Departure Hall);

If you hold a Tax Refund Form issued by Global Blue or Global tax free, please submit the form to, and get the refunded cash from, the tax refund office at the Transit Lounge (behind the Departure Hall) after having the form stamped at the Customs Inspection Counter;

If you hold a Tax Refund Form issued by Global Blue or Global tax free, please submit the form to, and get the refunded cash from, the tax refund office at the Transit Lounge (behind the Departure Hall) after having the form stamped at the Customs Inspection Counter;

If you hold a Tax Refund Form under the tax refund plan independently developed by the merchant, please post the form into the mailbox at airport. The form will be sent to the relevant merchant for processing.

If you hold a Tax Refund Form under the tax refund plan independently developed by the merchant, please post the form into the mailbox at airport. The form will be sent to the relevant merchant for processing.

If using Tourego app to apply for tax refund, the tax refund will be credited to the designated UnionPay card. After returning home, you can log on Tourego app or UnionPay international official website / wechat account to check the progress of tax refund.

If using Tourego app to apply for tax refund, the tax refund will be credited to the designated UnionPay card. After returning home, you can log on Tourego app or UnionPay international official website / wechat account to check the progress of tax refund.

South Korea

South Korea

UnionPay Tax Refund Procedure:

1. Complete the Tax Refund Form on purchase, choose credit card for receiving tax refund and fill in UnionPay card ( card number starting with 62).

2. Before departure, go to Customs Office for stamping.

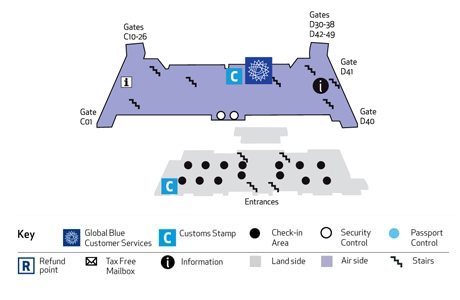

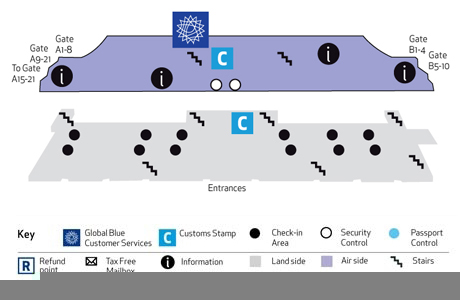

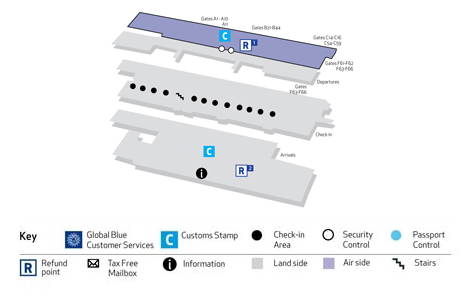

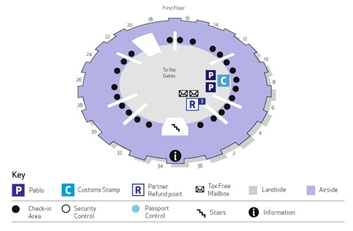

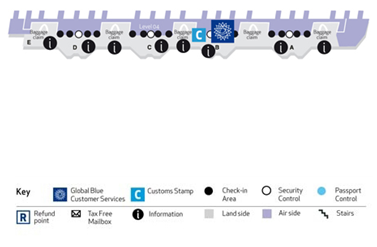

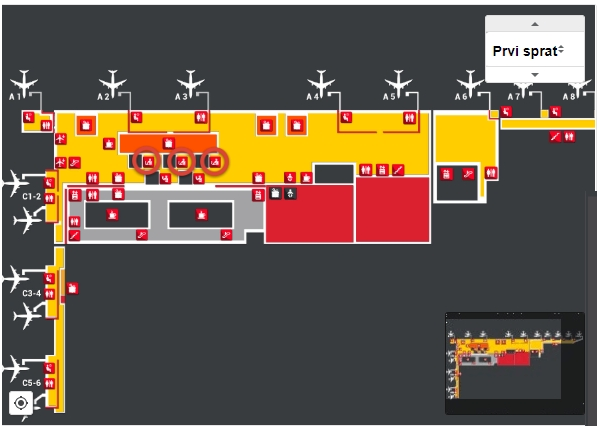

For example: at Incheon International Airport, Korea, the Customs Office is located at: Before Security Control - two Customs Stamps, each opposite Check-in Counter D and J on F3 of the Terminal; After Security Control - four Customs Stamps, each at Gate 1, 2, 3 and 4, for stamping and inspecting tax refund articles carried at hand.

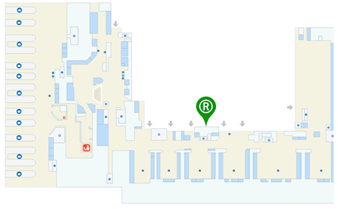

3. When you get to the left side of LV store near Gate 28 after stamping, you will see the Tax Refund Counters of the two tax refund companies (Global Tax Free and Global Blue) having cooperation with UnionPay, please put the Tax Refund Envelope into the mailbox.

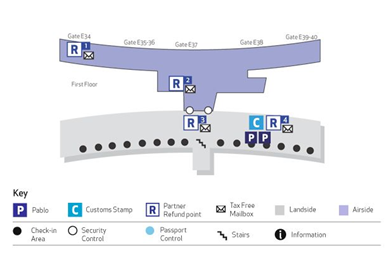

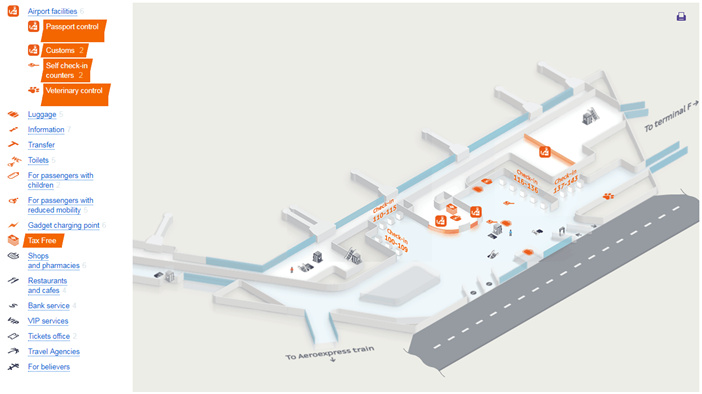

Incheon Airport

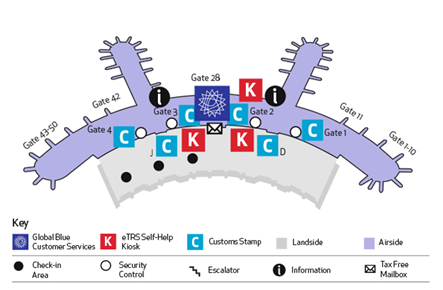

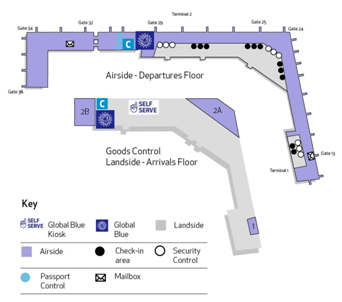

Tax refund at Incheon International Airport, Korea: If the amount of tax refund is less than KRW 75,000.00 (counted as purchasing amount between KRW 30,000 and KRW 2 million, about RMB 160~RMB 10,070), you may get tax refund at the Self-help Kiosk.

How to use:

① Scan your passport and Tax Refund Form at Tax Refund Kiosk in the departure lounge of Incheon International Airport.

② The tax refund machine displays the verification result, next step tips, and whether Customs scanning is required.

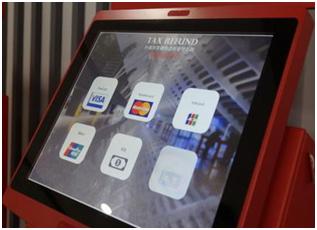

③ Get the tax refund at Tax Refund Kiosk by selecting UnionPay card (card number starting with 62) for receiving tax refund.

Tax Refund Kiosk at Incheon International Airport

Taiwan China Region

Taiwan China Region

UnionPay Tax Refund Tips

- Please arrive at the airport or port three (3) hours in advance and go through tax refund and other departure procedures at eTRS Self-help Kiosk or Tax Refund Service Counter. - Before luggage checking, scan your entry certificate and Tax Refund Particulars Application Form at eTRS Self-help Kiosk or Tax Refund Service Counter. The tax refund system will display whether the goods must be inspected by the Customs. Where no such inspection is required, you may go through the tax refund procedure at Tax Refund Kiosk or Tax Refund Service Counter.- UnionPay Credit Cardholders could apply for Downtown Early Refund with the credit card as guarantee, but if cardholders do not complete the requested process afterwards, the tax refund agency would have the rights to debit the refunded amount from the card.

Tax Refund Steps:

1. Make purchases and apply to merchants for Tax Refund Form

For cumulative UnionPay card purchases over NT$2,000.00 (including tax) in the same selected store posted with foreign passenger shopping tax refund logo on the same day, the cardholder may carry his/her entry certificate and apply to the store salesperson for the issuance of a Tax Refund Form on the day of purchase.

2. Complete the tax refund procedure at Tax Refund Kiosk/Tax Refund Service Counter of airport/port.

Within ninety (90) days after the date of purchase, UnionPay cardholders may go through the tax refund procedure at Tax Refund Kiosk/Tax Refund Service Counter (before luggage checking at departure) by carrying their Taiwan China Entry Permit, tax refund goods, invoices, and Tax Refund Particulars Application Form, and select UnionPay card for receiving tax refund.

Locations for application for tax refund

| Address | Location |

|---|---|

| Taipei International Airport | Customs Tax Refund Service Counter |

| Taiwan China Taoyuan International Airport Terminal 1 | Customs Service Counter on F1 of Departure Hall |

| Taiwan China Taoyuan International Airport Terminal 2 | Customs Service Counter on F3 of Departure Hall |

| Taichung Airport | Customs Service Center |

| Kaohsiung International Airport | Tariff Bureau Passenger Service Center on F3 |

| Hualien Airport | Passenger Service Center on F1 |

| Taiwan China International Ports Logistics Corporation Keelung Branch | East No.2 Wharf and West No.2 Wharf |

| Taiwan China International Ports Logistics Corporation Taichung Branch | Customs Service Counter at Passenger Service Center |

| Taiwan China International Ports Logistics Corporation Kaohsiung Branch | 3/F of Passenger Terminal Building |

| Taiwan China International Ports Logistics Corporation Hualien Branch | Passenger Service Center on F1 |

| Kinmen Waterhead Wharf | Customs Tax Refund Service Counter |

3. During tax refund procedure at airport, the system will display whether Customs inspection is required.

Upon inspection, Tax Refund Service Counter or eTRS Self-help Kiosk will print the tax refund particulars verification sheet for the UnionPay cardholder as receipt. After successful completion of the above steps, UnionPay will remit the tax refund to the cardholder's designated UnionPay card account within 5-10 working days.

Australia

Australia

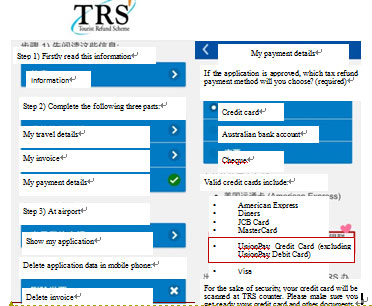

UnionPay Tax Refund Steps:

1. Get the tax invoice upon purchase over AUD 300.00 at the same merchant.

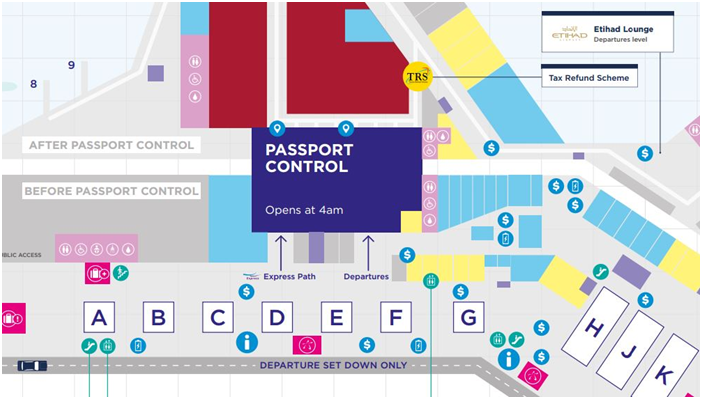

2. Before departure, go through the tax refund procedure at TRS Facility by carrying your tax refund goods, tax invoice, passport and boarding pass. Select UnionPay card (card number starting with 62) for receiving tax refund. You will receive tax refund within 5-10 days.

If tax-free goods are within the check-in luggage, please paste a tag on the luggage when going through the boarding procedure, take tax-free goods to the Customs Office for inspection, and get the tax refund voucher before having the goods checked. Pass the security check and go through follow-up formalities with the Tax-free Counter upon presentation of your tax refund voucher.

UnionPay Tax Refund Tips:

In Australia, no tax refund will be paid in cash. So, we recommend you to use a UnionPay credit card to receive tax refund.

In Australia, no tax refund will be paid in cash. So, we recommend you to use a UnionPay credit card to receive tax refund.

Japan

Japan

UnionPay Tax Refund Steps:

1. For any purchase over 5,000.00 Yen in stores posted with Tax-Free logo, please claim for tax refund (reference GST rate: 8%) from the store assistant by presenting your sales slip and passport.

2. Please present your UnionPay card at TRS counter and ask the store assistant to pay tax refund to your card; some stores may directly deduct tax refund when you pay the bill.

3. Conserve the Tax Refund Confirmation (which will generally be pasted to one of your passport pages) for inspection by the Customs.

Some small stores, such as drug stores, supermarkets and convenience stores, may not be posted with the Tax-Free logo. Please show your passport to the store assistant and inquire whether tax refund is available.

Some small stores, such as drug stores, supermarkets and convenience stores, may not be posted with the Tax-Free logo. Please show your passport to the store assistant and inquire whether tax refund is available.

Mainland China

Mainland China

UnionPay Tax Refund Steps:

Standard VAT rate:13% (general goods),9% (agricultural product, edible vegetable oil, books etc)

For goods which applied to VAT rate 13%, the refund amount is 11% of VAT invoice .For goods which applied to VAT rate 9%, the refund amount is 8% of VAT invoice. (processing fee will be deducted from refund amount, and rate varies in different cities, e.g. 2% of VAT invoice charged in Shanghai)

Foreign visitors holding valid passport, Hong Kong,China, Macau China and Taiwan China residents holding Mainland Travel Permit

The Traveler should stay in Mainland China for no more than 183 consecutive days (according to the date of entry to China in your passport); Purchase date does not exceed 90 days from the date of departure.

The minimum purchase amount for tax refund is RMB 500/TFS store/day/customer.

When leaving the country, foreign passengers should go through the formalities of checking and confirming the items of tax refund to the customs. Overseas passengers shall submit the following information when applying to the tax refund agency for departure tax refund:

(1) his/her valid identity certificate;

(2) application form for tax refund for departure verified and signed by the customs.

Then they may head for any one of the specific tax refund locations to receive their tax refund.

Please arrive early at the airport (min.3 hours before take-off)

Please arrive early at the airport (min.3 hours before take-off)

Shanghai Hongqiao International Airport/Shanghai Pudong International Airport Terminal 1/ Shanghai Pudong International Airport Terminal 2 (Departure) /Shanghai Downtown (for overseas tourists)

Beijing Capital International Airport Terminal 2 /Beijing Capital International Airport Terminal 3 /Shanghai Pudong International Airport Terminal 2 (Arrival) /Shanghai Downtown (for Chinese tourists) /Guangzhou Downtown/Guangzhou Airport /Beijing Downtown

United Arab Emirates

United Arab Emirates

UnionPay Tax Refund Steps:

The policy has not been implemented, which means that the UAE airport is not open counters for tourists to refund taxes. At present, the only way to refund the tax is to fill out the tax refund form and give the customs a knockout, and then go to the designated tax refund point.

Bahrain

Bahrain

UnionPay Tax Refund Steps:

The minimum purchase amount for tax refund is 100 BD per individual receipt. Purchasers need to hold valid receipts or proof of purchase; otherwise, no refund will be given. Purchase date does not exceed 60 days from the date of departure.

Your sales receipt with the VAT refund tag affixed to the back. Purchased goods (please go to the validation desks before you check in your luggage, as you will have to show the goods to our validation staff). At the same time ,please show us your passport and travel ticket.

Switzerland

Switzerland

UnionPay Tax Refund Procedure:

1. Tax refund is available for any purchase over 300.00 Swiss franc in Switzerland; when completing the Tax Refund Application, please select credit card for receiving tax refund, and complete a UnionPay card having card number starting with 62 and other necessary information (reference tax free rate: 8%).

2. Get the tax refund forms stamped by the airport Customs.

3. Find an airport tax refund counter or a mailbox to post the tax refund forms.

UnionPay Tax Refund Tips:

Switzerland is a Schengen State but not a member state of EU. Therefore, tax refund for purchases occurring in Switzerland must be claimed on departure from Switzerland. Tax refund for purchases made outside Switzerland must not be applied for in Switzerland.

United Kingdom

United Kingdom

UnionPay Tax Refund Steps:

1. Tax refund is available for any purchase over 30 pounds in UK; when completing the Tax Refund Application, please select credit card for receiving tax refund, and fill in UnionPay card number(starting with 62) and other necessary information.

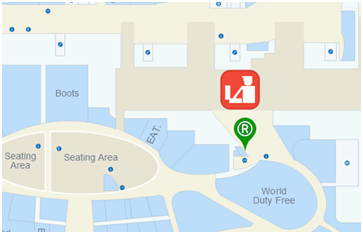

2. The Refund points outside the Terminal will save you the trouble of getting your Tax Refund From stamped by the Customs. Travelex will uniformly collect the Tax Refund Forms and have them stamped by the Customs. Tax refund is available for goods valued more than 24.90 pound sterling (except for jewelry, ornaments and watch).

3. At the Refund points behind Security Control, tax refund is available for all goods listed in completed Tax Refund Form, with Customs stamp: after passing Security Control, follow the sign to find the Customs and complete stamping; and post the Tax Refund Form and Tax Refund Envelope into the red mailbox (on the left of Travelex counter behind the Security Control).

4. In the case of tax refund in cash, extra fees (2.70 pound sterling) will be charged for each Tax Refund Form. If you choose to receive tax refund with UnionPay card, no such fee will be charged.

Ireland

Ireland

UnionPay Tax Refund Procedure:

1. Tax refund is available for any purchase over 30.00 Euro; when completing the Tax Refund Application, please select credit card for receiving tax refund, and fill in a UnionPay card having card number starting with 62 and other essential information.

2. Stamped by the airport Customs (to enjoy the tax refund service at the Customs of Dublin Airport, you need to make a call to the airport).

3. Mail the Tax Refund Form and sales slips.

UnionPay Tax Refund Tips:

France

France

UnionPay Tax Refund Tips:

Information on Paris CDG Refund Points:

| T1: | CDG VAL Hall 6 |

| T2A: | Departure Gate 5 |

| T2C: | Departure Gate 4 |

| T2E: | Departure Gate 8 |

| T2F: | Arrival |

| Terminal 3: | Landside Departure |

Germany

Germany

UnionPay Tax Refund Steps:

1. Apply for tax refund after purchase; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62.

2. To get tax refund, you must firstly get the boarding pass by going through the boarding procedure (if tax-free goods are within the check-in luggage, please inform the airport staff in advance and take back the luggage after it is pasted with a tag), and then present your boarding pass, passport, Tax Refund Form, tax-free goods, and sales slip to the Customs for stamping of the Tax Refund Form.

3. Deliver the stamped Tax Refund Form to the counter of corresponding tax-free company or post it into the mailbox.

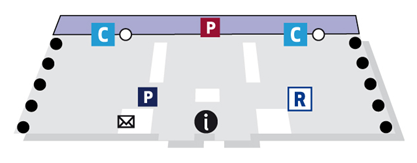

Stamped by the Customs:

Customs Counter before Security Control: Counter 643 - German Customs is next to the Tax-free Counter

Customs Counter after Security Control: beside Boarding Gate B42

Tax-free Counter:

Daytime: Counter 643 - Tax-free Counter before Security Control is beside the Customs,

Night time: changed to Section B Luggage Inquiry Counter during 21:30-6:30

Tax-free Counter after Security Control is beside the Customs at Boarding Gate B42. Tax Free Mailbox is generally beside the Tax-free Counter

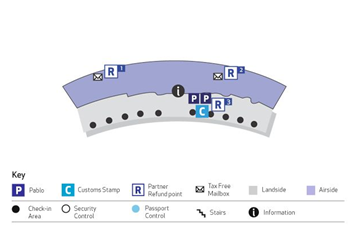

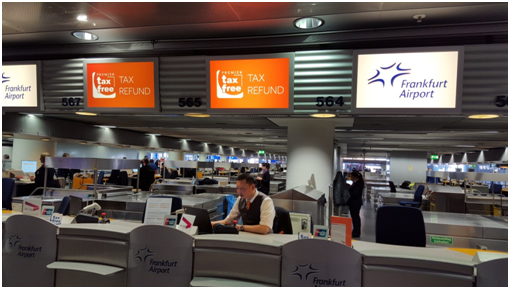

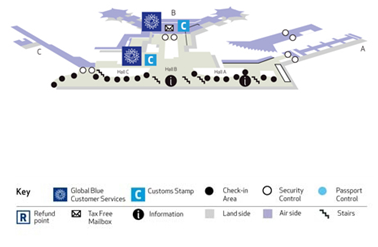

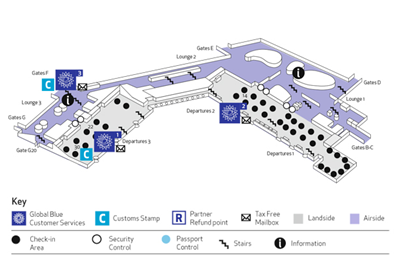

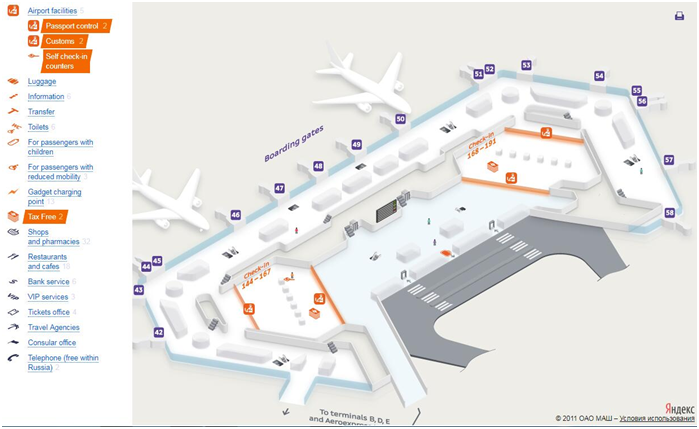

Frankfurt Terminal 1

Italy

Italy

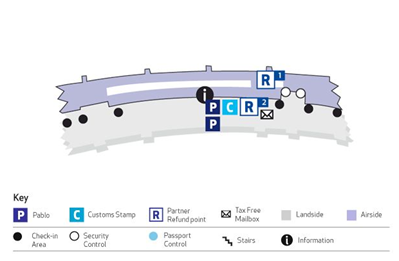

Rome Fiumicino T3

1. For any purchase over 154.94 Euro in stores posted with Tax-Free logo, please claim Tax Refund only with passport information available at the store and select UnionPay card (card number starting with 62) for receiving tax refund. Please note that the card should be printed with Cardholder’s name.

2. To get tax refund at Roman airports, you must firstly get a boarding pass by going through the boarding procedure: If you have carry-on luggage only, you can directly pass the Security Control, and then go to the Customs Office to have your Tax Refund Form stamped; If tax-free goods are included in check-in luggage, please inform the airport staff in advance and take back the luggage after it is pasted with a tag), and then carry your tax-free goods to the Customs for tax refund approval.

3. Apply for tax refund paid to UnionPay card at the Refund point after completion of stamping.

The Refund point is located at Boarding Gate H1 after Security Control.

Post the Tax Refund Form and Tax Refund Envelope into the red mailbox opposite the tax refund inspection window (Note: Tax Refund Forms issued in Italy shall be posted into the left mailbox labeled with ROMA logo while those issued in other countries into the right mailbox).

Information on Other Airports

Spain

Spain

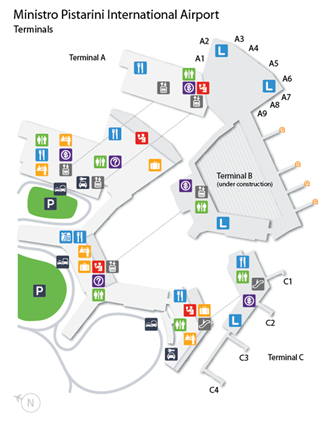

Madrid Airport UnionPay Tax Refund Steps:

1. Claim Tax Refund upon any purchase (with no minimum spend), and select UnionPay card (card number starting with 62) for receiving tax refund.

2. Tax refund can be applied for in Terminal T1 and T4 at Madrid Airport; please follow the sign (Aduana) in Spanish to find the Tax-free Counter.

Customs Stamp:

- T1 Customs Window is on the left of F1 Departure and near Check-in Window 200;

- T1 Customs Window is on the left of F1 Departure and near Check-in Window 200;

- T4 Customs Window is within F2 Departure Area and beside Security Control;

- T4 Customs Window is within F2 Departure Area and beside Security Control;

The business hours in both places are between 7:00-22:00. If you find no one working at the window during business hours, please press the bell beside the window. The Customs staff will come out on hearing the bell. - there is no need to get custom stamp for tax refund form with DIVA logo. You can find the DIVA automatic tax refund machine at the airport. Just follow the instructions on the machine and scan the tax return barcode, passport, etc.

3. Deliver the stamped Tax Refund Form to the Tax-free Counter or directly or post it into the mailbox.

- The Tax Refund Envelope issued by Global Blue is prepaid and can be posted to any of the yellow mailboxes at the airport.

- The Tax Refund Envelope issued by Global Blue is prepaid and can be posted to any of the yellow mailboxes at the airport.

- After T1 Security Control, you will see a Global Blue Counter labeled with a blue sign where you may submit the Tax Refund Form directly to the counter clerk.

- After T1 Security Control, you will see a Global Blue Counter labeled with a blue sign where you may submit the Tax Refund Form directly to the counter clerk.

*In the case of tax refund in cash, extra fees (3.00 Euro) will be charged for each Global Tax Refund Form (no handling charge will be charged for Tax Refund Forms issued in Spain). If you choose to receive tax refund with UnionPay cards, no such fee will be charged.

Portugal

Portugal

UnionPay Tax Refund Steps:

1. For any purchase over 50.00-60.00 Euro in the same tax-free store on the same day, tourists from non-EU member states may claim a Tax Refund Form from the store assistant and select UnionPay card (card number starting with 62) for receiving tax refund.

2. Go through the boarding procedure, present your Tax Refund Application Form, passport, visa and purchased goods to the Customs for stamping of the Tax Refund Application Form (The Customs Stamp of Brisbane Airport is located at Check-in Counter 101), and then have your luggage checked.

3. Post the stamped Tax Refund Form into the Tax Free Mailbox.

UnionPay Tax Refund Tips:

Please note that in Portugal, the minimum amount of purchase for tax refund varies with the VAT type.

EUR 52.87 (6%)

EUR 52.87 (6%)

EUR 56.36 (13%)

EUR 56.36 (13%)

EUR 61.35 (23%)

EUR 61.35 (23%)

EUR 57.87 (16%)

EUR 57.87 (16%)

EUR 60.85 (22%)

EUR 60.85 (22%)

Locations of the Customs and Global Blue Tax-free Counter at Lisbon Airport

Netherlands

Netherlands

UnionPay Tax Refund Steps:

1. For any purchase over 50.00 Euro in the same tax-free store on the same day, tourists from non-EU member states may claim a GST Refund Form from the store assistant and select UnionPay card (card number starting with 62) for receiving tax refund.

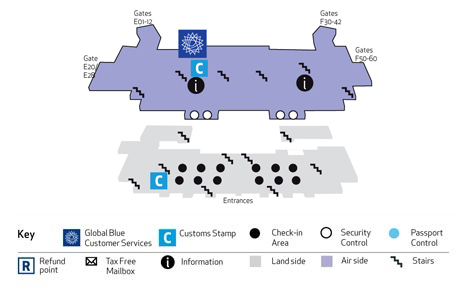

2. Before going through the boarding procedure, please present your Tax Refund Application Form, passport, visa and purchased goods to the Customs for stamping of the Tax Refund Application Form;

a) Please note that if the amount of purchase is more than 2,000.00 Euro (inclusive), please have the Tax Refund Application Form stamped at the Customs Office opposite Departure Hall 2 Boarding Gate D10;

a) Please note that if the amount of purchase is more than 2,000.00 Euro (inclusive), please have the Tax Refund Application Form stamped at the Customs Office opposite Departure Hall 2 Boarding Gate D10;

b) If the amount of purchase is less than 2,000.00 Euro, please have the Tax Refund Application Form stamped at the Customs Office between departure Lounge 2 and 3;

b) If the amount of purchase is less than 2,000.00 Euro, please have the Tax Refund Application Form stamped at the Customs Office between departure Lounge 2 and 3;

3. Post the stamped Tax Refund Form into the Tax Free Mailbox. The nearest Tax-free Counter is next to the Customs Counter.

Belgium

Belgium

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 50.00 Euro in the same tax-free store on the same day; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62. (Reference tax free rate: 21% for general goods; 6% for food; handling charge will be deducted by the tax-free company)

2. When departing from Island, please present your passport, Tax Refund Form, tax-free goods and sales slip to the Customs Office (Brussels International Airport Customs Office is near International Departure Gate B) for examination and tax refunding before going through the boarding procedure.

3. Post the stamped Tax Refund Form together with the sales slip to the mailbox.

UnionPay Tax Refund Tips:

Luxembourg

Luxembourg

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 74.00 Euro; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62. (Reference tax free rate: VAT 15%)

2. When departing from Island, please present your passport, Tax Refund Form, tax-free goods and sales slip to the Customs Office (near Luxembourg-Findel International Airport International Arrival Gate B) for examination and tax refunding before going through the boarding procedure.

3. Post the stamped Tax Refund Form together with the sales slip to the mailbox.

UnionPay Tax Refund Tips:

Greece

Greece

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 120.00 Euro in the same tax-free store; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62.

2. Before going through the boarding procedure, please apply to the Customs Office for tax refund by presenting your Tax Refund Form, passport, tax-free goods and sales slip to the Customs Office for inspection and stamping;

3. Mail the stamped Tax Refund Form; or after Security Control, submit the Tax Refund Form to corresponding Tax-free Counter or post it into corresponding mailbox.

UnionPay Tax Refund Tips:

No tax refund is available for wines and food purchased in Greece.

No tax refund is available for wines and food purchased in Greece.

The validity term of Tax Refund Form stamped by the Customs shall be within ninety (90) days since the date of purchase. You must have your Tax Refund Form stamped by the Greek Customs or the Customs of other EU member state within three (3) months from the month of purchase.

The validity term of Tax Refund Form stamped by the Customs shall be within ninety (90) days since the date of purchase. You must have your Tax Refund Form stamped by the Greek Customs or the Customs of other EU member state within three (3) months from the month of purchase.

In addition to the stamp of Greek Customs, the Tax Refund Form must also bear the name of Customs officer.

In addition to the stamp of Greek Customs, the Tax Refund Form must also bear the name of Customs officer.

The tax free rate is 24% for Greek Island and Aegean Island and 17% for other small islands.

The tax free rate is 24% for Greek Island and Aegean Island and 17% for other small islands.

when the customs seal, pay attention to each joint must be covered, do not leak 。

when the customs seal, pay attention to each joint must be covered, do not leak 。

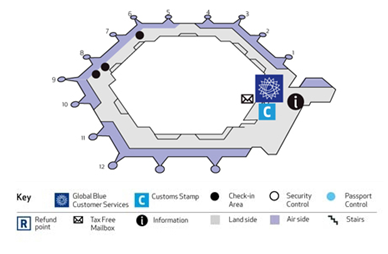

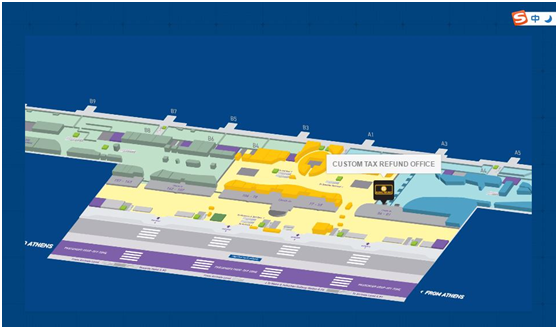

Location of Greece Athens Airport Customs

Athens International Airport

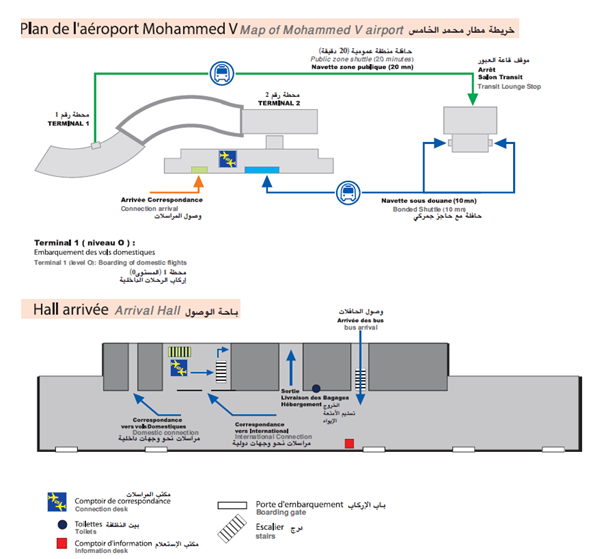

Morocco

Morocco

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 2,000.00 Morocco Dirham (about RMB 1,372.00); when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62.

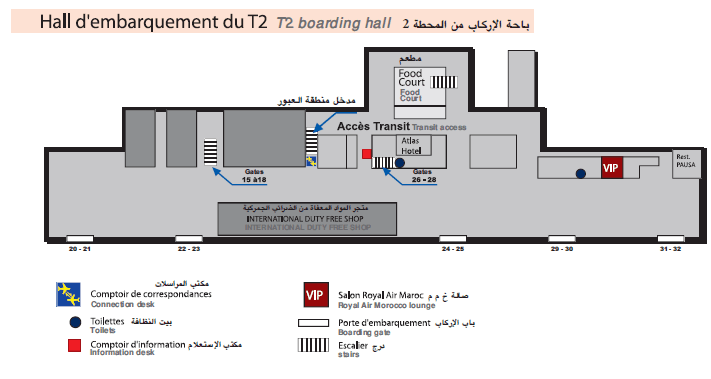

2. Before going through the boarding procedure, please apply to the Customs Office for tax refund by presenting your Tax Refund Form, passport, tax-free goods and sales slip to the Customs Office for inspection and stamping. In Morocco, tax refund can be applied for at Casablanca Airport and Marrakech Airport.

3. Post the stamped Tax Refund Form to the counter or mailbox of corresponding tax-free company. You will receive the tax refund within 10 days.

UnionPay Tax Refund Tips:

No tax refund is available for the following goods: food (solid and liquid), tobacco, medicines, gem, transportation for private uses, proprietary cultural relics.

No tax refund is available for the following goods: food (solid and liquid), tobacco, medicines, gem, transportation for private uses, proprietary cultural relics.

Cash rebate: limited to 5,000 Moroccan dirhams (or equivalent euro/dollar) using UnionPay card without this restriction

Cash rebate: limited to 5,000 Moroccan dirhams (or equivalent euro/dollar) using UnionPay card without this restriction

tax refund counter address and open hours:

tax refund counter address and open hours:

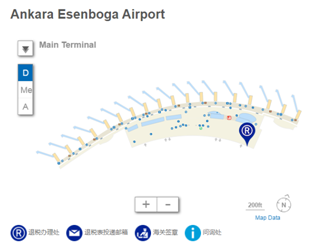

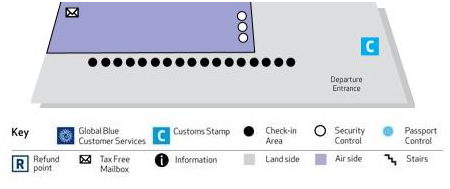

Turkey

Turkey

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 100.00 New Turkish Lira (about RMB292.00); when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62.

2. If tax-free goods are within the check-in luggage, then before going through the boarding procedure, please apply to the Customs Office for tax refund by presenting your Tax Refund Form, passport, tax-free goods and sales slip to the Customs Office for inspection and stamping. also if you do not have a shopping receipt, the tax free form must indicate the product details and with the invoice number printed in red.

If tax-free goods are within the carry-on luggage, please go through the tax refund procedure with the Customs Office at the Departure Hall after Security Control.

3. Post the stamped Tax Refund Form to the counter or mailbox of corresponding tax-free company.

UnionPay Tax Refund Tips:

No tax refund is available for the following goods: food (solid and liquid), tobacco, medicines, gem, transportation for private use, proprietary cultural relics.

Cyprus

Cyprus

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 50.00 Euro in the same tax-free store; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62 (reference tax free rate: VAT 18%; handling charge will be charged by the tax-free company).

2. Before going through the boarding procedure, please apply to the Customs Office for tax refund by presenting your Tax Refund Form, passport, tax-free goods and sales slip to the Customs Office for inspection and stamping. (Customs Stamp is opposite to the Security Control.)

3. Mail the stamped Tax Refund Form; or after Security Control, submit the Tax Refund Form to corresponding Tax-free Counter or post it into corresponding mailbox.

Global Blue, Planet, and Tax Free Worldwide all support UnionPay tax refund:

UnionPay Tax Refund Tips:

No tax refund is available for food purchased in Cyprus.

Lebanon

Lebanon

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 150,000.00 Lebanese pound (about RMB655.00); when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62 (reference tax free rate: VAT 10%).

2. Before going through the boarding procedure, please apply to the Customs Office for tax refund by presenting your Tax Refund Form, passport, tax-free goods and sales slip to the Customs Office for inspection and stamping (Counter of the tax-free company is opposite the Passport Control; Customs Stamp is on the right of Tax-free Counter).

3. Post the stamped Tax Refund Form to the counter or mailbox of corresponding tax-free company.

UnionPay Tax Refund Tips:

No tax refund is available for food, beverages, gem, jewelry and ornaments.

Malta

Malta

UnionPay Tax Refund Steps:

Standard VAT rate 18%; books, pharmaceuticals 5%. Actual tax refund value subject to amount spent and Terms and Conditions.

Tax refund service is available to Non-EU residents. The minimum purchase amount for tax refund is 100 Euro per individual receipt.

Purchase date does not exceed 90 days from the date of departure. Theoretically, a tax refund form stamped with a valid customs seal is valid for three years from the date of issuance of the tax refund form.

When leaving the country, please show the sealed and unused goods, tax refund form and shopping receipt to the customs, and ask the customs officer to stamp the customs seal on the corresponding place of the tax refund form. Do not consign the goods for customs inspection until they have been stamped by the customs. A tax refund form without customs seal shall be deemed to be invalid.

After returning to China, you can apply for tax refund service with the tax refund form with customs seal, shopping receipt and personal passport. Note: please come here in person.

UnionPay Tax Refund Tips:

Required for customs approval: fully completed tax free form purchased goods and receipts Passport and travel documents

Required for customs approval: fully completed tax free form purchased goods and receipts Passport and travel documents

If you receive a City Cash refund in your shopping destination, you must get your Tax Free form approved by Customs and return it to Planet within 21 days and the original store receipt or your credit card used for guarantee will get charged.

If you receive a City Cash refund in your shopping destination, you must get your Tax Free form approved by Customs and return it to Planet within 21 days and the original store receipt or your credit card used for guarantee will get charged.

At the airport, please allow enough time for Customs approval process before your flight departs.

At the airport, please allow enough time for Customs approval process before your flight departs.

Make sure the goods are sealed and unused.

Make sure the goods are sealed and unused.

If you are departing from Malta International Airport but changing flights at another EU airport, and if the goods you are exporting are to be checked through to a destination outside the EU, go to Customs at the airport in Malta and your Tax Free form will be export validated as if you were at the EU departure point.The Baltic Sea Region

If you are departing from Malta International Airport but changing flights at another EU airport, and if the goods you are exporting are to be checked through to a destination outside the EU, go to Customs at the airport in Malta and your Tax Free form will be export validated as if you were at the EU departure point.The Baltic Sea Region

Czech Republic

Czech Republic

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 2,001.00 Czech Koruna (about RMB551.00); when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62 (reference tax free rate: 21% for general goods: 15% for books, medicines, and spectacles; the tax refund received will deduct the handling charge charged by the tax-free company).

2. If tax-free goods are within the check-in luggage, then before going through the boarding procedure, please apply to the Customs Office for tax refund by presenting your Tax Refund Form, passport, tax-free goods and sales slip to the Customs Office for inspection and stamping.

If tax-free goods are within the carry-on luggage, please go through the tax refund procedure with the Customs Office at the Departure Hall after Security Control.

3. Post the stamped Tax Refund Form to the counter or mailbox of corresponding tax-free company.

UnionPay Tax Refund Tips:

No tax refund is available for the following goods: food, spirit and automobiles

No tax refund is available for the following goods: food, spirit and automobiles

As Czech Republic is a member state of EU, tax refund for purchases made in Czech Republic can be applied for in the last member state before departure from EU. Accordingly, if you are heading for China from Czech Republic, tax refund for purchases made in other member states can also be applied for in Czech Republic.

As Czech Republic is a member state of EU, tax refund for purchases made in Czech Republic can be applied for in the last member state before departure from EU. Accordingly, if you are heading for China from Czech Republic, tax refund for purchases made in other member states can also be applied for in Czech Republic.

In the case of tax refund in cash, handling charge of 80.00 krone (about RMB22.00) will be charged for each Tax Refund Form. If you choose to receive tax refund with UnionPay cards, no such fee will be charged.

In the case of tax refund in cash, handling charge of 80.00 krone (about RMB22.00) will be charged for each Tax Refund Form. If you choose to receive tax refund with UnionPay cards, no such fee will be charged.

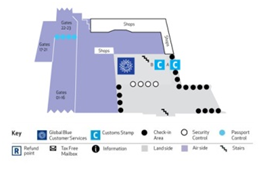

Locations of Customs Office and Tax-free Counter:

Václav Havel Airport Prague

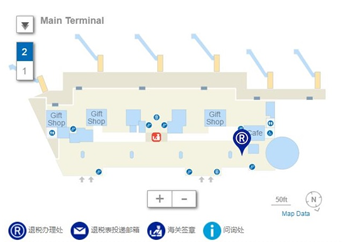

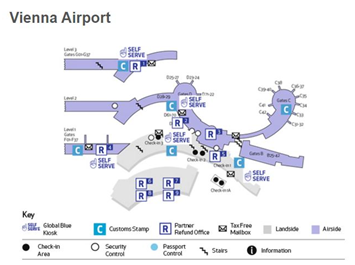

Austria

Austria

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 75.01 Euro; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62.

2. If tax-free goods are within the check-in luggage, then before going through the boarding procedure, please apply to the Customs Office for tax refund by presenting your Tax Refund Form, passport, tax-free goods and sales slip to the Customs Office for inspection and stamping.

If tax-free goods are within the carry-on luggage, please go through the tax refund procedure with the Customs Office at the Departure Hall after Security Control.

3. Post the stamped Tax Refund Form to the counter or mailbox of corresponding tax-free company.

UnionPay Tax Refund Tips:

As Austria is a member state of EU, tax refund for purchases made in Austria can be applied for in the last member state before departure from EU. Accordingly, if you are heading for China from Austria, tax refund for purchases made in other member states can also be applied for in Austria.

As Austria is a member state of EU, tax refund for purchases made in Austria can be applied for in the last member state before departure from EU. Accordingly, if you are heading for China from Austria, tax refund for purchases made in other member states can also be applied for in Austria.

In the case of tax refund in cash, 3.00 Euro handling charge will be charged for each Tax Refund Form. If you choose to receive tax refund with UnionPay cards, no such fee will be charged.

In the case of tax refund in cash, 3.00 Euro handling charge will be charged for each Tax Refund Form. If you choose to receive tax refund with UnionPay cards, no such fee will be charged.

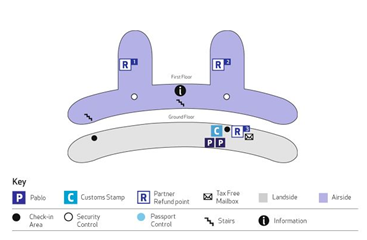

Locations of the Customs and Tax-free Counter/Mailbox at Vienna International Airport:

Hungray

Hungray

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 55,000.01 Hungarian forint (about RMB1,334.50); when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62.

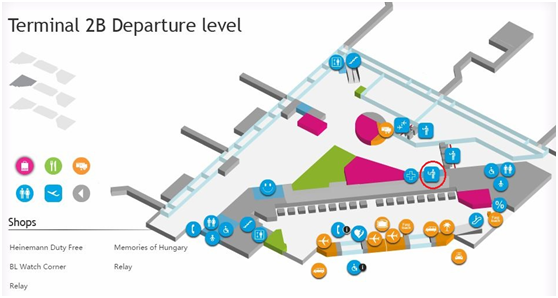

2. Note: Budapest Liszt Ferenc International Airport has only one International Departure Customs Check Point which is located outside the Security Control in Terminal 2B; if your Check-in Counter is located in Terminal 2A, tax refund shall also be applied for at this Check Point.

3. Mail the Tax Refund Form.。

UnionPay Tax Refund Tips:

As Hungary is a member state of EU, tax refund for purchases made in Hungary can be applied for in the last member state before departure from EU. Accordingly, if you are heading for China from Hungary, tax refund for purchases made in other member states can also be applied for in Hungary.

As Hungary is a member state of EU, tax refund for purchases made in Hungary can be applied for in the last member state before departure from EU. Accordingly, if you are heading for China from Hungary, tax refund for purchases made in other member states can also be applied for in Hungary.

Location of the Customs at Budapest Ferihegy International Airport:

Slovakia

Slovakia

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 175.01 Euro in the designated tax-free store; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62 (reference tax free rate: VAT 20%).

2. If tax-free goods are within the check-in luggage, then before going through the boarding procedure, please apply to the Customs Office for tax refund by presenting your Tax Refund Form, passport, tax-free goods and sales slip to the Customs Office for inspection and stamping.

If tax-free goods are within the carry-on luggage, please go through the tax refund procedure with the Customs Office at the Departure Hall after Security Control.

3. Post the stamped Tax Refund Form to the counter or mailbox of corresponding tax-free company.

UnionPay Tax Refund Tips:

As Slovakia is a member state of EU, tax refund for purchases made in Slovakia can be applied for in the last member state before departure from EU. Accordingly, if you are heading for China from Slovakia, tax refund for purchases made in other member states within three (3) months can also be applied for in Slovakia.

As Slovakia is a member state of EU, tax refund for purchases made in Slovakia can be applied for in the last member state before departure from EU. Accordingly, if you are heading for China from Slovakia, tax refund for purchases made in other member states within three (3) months can also be applied for in Slovakia.

In the case of tax refund in cash, 3.00 Euro handling charge will be charged for each Tax Refund Form. If you choose to receive tax refund with UnionPay cards, no such fee will be charged.

In the case of tax refund in cash, 3.00 Euro handling charge will be charged for each Tax Refund Form. If you choose to receive tax refund with UnionPay cards, no such fee will be charged.

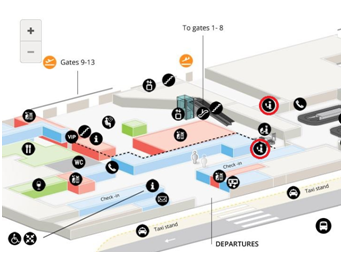

Slovakia Bratislava Airport IVANKA Customs Check Point

Slovenia

Slovenia

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 50.01 Euro in a single receipt; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62.

2. If tax-free goods are within the check-in luggage, then before going through the boarding procedure, please apply to the Customs Office for tax refund by presenting your Tax Refund Form, passport, tax-free goods and sales slip to the Customs Office for inspection and stamping.

If tax-free goods are within the carry-on luggage, please go through the tax refund procedure with the Customs Office at the Departure Hall after Security Control.

3. Post the stamped Tax Refund Form to the counter or mailbox of corresponding tax-free company.

UnionPay Tax Refund Tips:

Location of Ljubljana Airport Customs:(As shown in the picture, there are two Customs Offices, each being located in and outside the Security Control)

Croatia

Croatia

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 740 Kuna (about RMB680.00) in a single receipt; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62.

2. If tax-free goods are within the check-in luggage, then before going through the boarding procedure, please apply to the Customs Office for tax refund by presenting your Tax Refund Form, passport, tax-free goods and sales slip to the Customs Office for inspection and stamping.

If tax-free goods are within the carry-on luggage, please go through the tax refund procedure with the Customs Office at the Departure Hall after Security Control.

3. Post the stamped Tax Refund Form to the counter or mailbox of corresponding tax-free company.

UnionPay Tax Refund Tips:

As Croatia is a member state of EU, tax refund for purchases made in Croatia can be applied for in the last member state before departure from EU. Accordingly, if you are heading for China from Croatia, tax refund for purchases made in other member states within three (3) months can also be applied for in Croatia.

Location of Zagreb International Airport Customs:

Russia

Russia

UnionPay Tax Refund Steps:

1. Claim tax refund upon spending more than 10,000 Russian rubles (about 1178 yuan) in the same designated merchant in one day. Please select the UnionPay card with the card number starting with 62 as the tax refund payment option. (The tax refund rate is about 11%)

2. Before departure get tax refund forms stamped by the customs.

3. - If you are going to claim by yourself, you can put the receipts and forms into a specified mailbox near the tax refund points. After one or two weeks, the tax refund amount will be paid to the UnionPay card. This method allows consumers to get a full refund.

- Consumers can also choose to refund the tax through the tax-free system. Submit the form and receipt to the tax refund counters for review. (The tax-free system is operated by Russian domestic operators and two foreign companies Global Blue and Planet, so consumers need to find the signs of the two companies at the VAT tax refund point) but this method will generate 5%~ 15% handling fee.

UnionPay Tax Refund Tips:

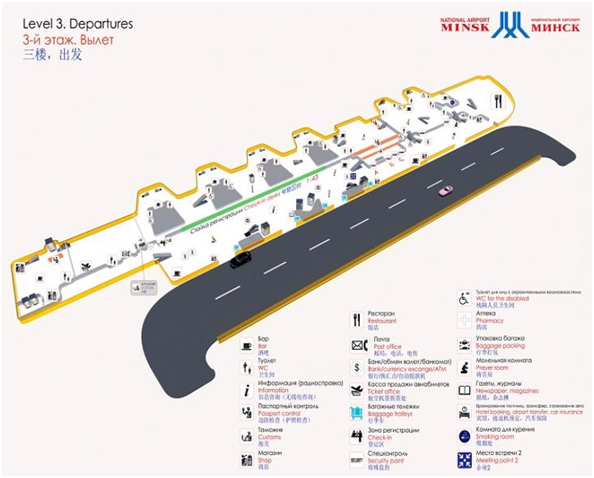

Belarus

Belarus

UnionPay card tax refund steps:

Claim tax refund upon spending more than 93 Belarusian rubles (about 320 RMB). Please choose the UnionPay card with the card number starting with 62 as the tax refund payment option.

Before departure, the tax refund form must be stamped by the customs. The tax refund goods must be displayed to the customs to ensure that the goods will be taken out of Belarus. Please check in to collect your boarding pass before going for the custom approval. Be sure to take out the baggage from the tax refunded goods or inform the customs to avoid unnecessary trouble. Then bring the tax refund form, shopping voucher and boarding documents to the customs counter to obtain the customs seal.

UnionPay Tax Refund Tips:

Macedonia

Macedonia

Macedonia Tax Refund Points UnionPay Tax Refund Steps:

1. In Macedonia, in most countries, Macedonia Airport does not provide tax refund services. Visitors are required to go to the designated tax refund point of CortEx to enjoy the full VAT refund service. Please select the UnionPay card with the card number starting with 62 as the tax refund payment option.

2. Non-local visitors are required to bring valid documents and designated store payment credentials. After approval by the tax refund agency, the VAT received will be refunded in full.

UnionPay Tax Refund Tips:

Moldova

Moldova

Macedonia Tax Refund Points UnionPay Tax Refund Steps:

1. After shopping at stores with tax refund labels for over 300 MDL (around 360 RMB), foreign tourists can enjoy value-added tax refund. Any goods purchased from labelled shops will grant consumers rights to be tax refunded. When filling out the tax refund form, please select the credit card tax refund and fill in the UnionPay card number with the card number starting with 62.( Most of the value-added tax charged in Moldova is 20%, 8% or 0% reduced tax may exists in some transactions.)

2. Get the custom stamp before departure

3. Submit the valid tax refund from to the tax refund counters.

UnionPay Tax Refund Tips:

Serbia

Serbia

UnionPay Tax Refund Steps:

1. Buying goods at the same store for 200 euros (about 1515.86 yuan) request a refund form from the retailer with valid invoices. Please select the UnionPay card with the card number starting with 62 as the tax refund payment option. (VAT is 20%, most products will be refunded up to 20% VAT)

2. get the forms stamped by the Customs before departure.

3.Go to the specified tax refund counter at airports or to the tax refund companies, such as Global Blue, to receive the VAT refund.

UnionPay Tax Refund Tips:

Ukraine

Ukraine

UnionPay Tax Refund Steps:

Foreign individuals cannot be registered as VAT payers. Therefore, the VAT generated in shopping in Ukraine cannot be returned. The only individual that can be refunded is a foreign enterprise registered as VAT payer in Ukraine

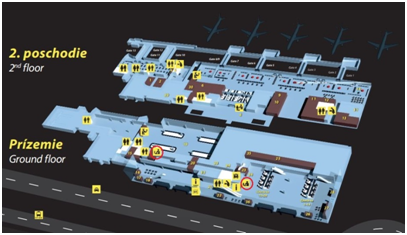

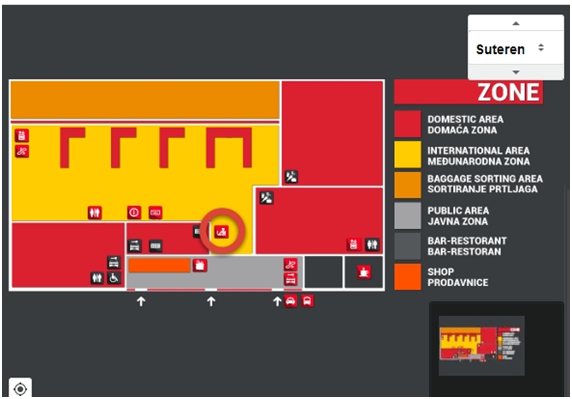

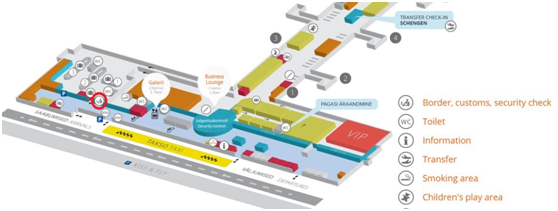

Boryspil International Airport

-

Terminal D 2 level

-

Terminal D 3 level

Denmark

Denmark

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 300 Danish krone (about RMB 302.00) in a single receipt; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62. In Denmark, the VAT rate is 25% and the actual tax refund form is between 12-25%.

2. Go through the boarding procedure and then present your boarding pass, passport, Tax Refund Form, tax-free goods and sales slip to Terminal 3 Customs Service Counter for stamping. If tax-free goods are within the check-in luggage, please inform the airport staff in advance and complete the tax refund procedure before having the luggage checked.

3. Post the stamped Tax Refund Form to the counter or mailbox of corresponding tax-free company.

UnionPay Tax Refund Tips:

As Denmark is a member state of EU, tax refund for purchases made in Denmark can be applied for in the last member state before departure from EU. Accordingly, if you are heading for China from Denmark, tax refund for purchases made in other member states within three (3) months can also be applied for in Denmark.

As Denmark is a member state of EU, tax refund for purchases made in Denmark can be applied for in the last member state before departure from EU. Accordingly, if you are heading for China from Denmark, tax refund for purchases made in other member states within three (3) months can also be applied for in Denmark.

Tax Refund Forms for purchases made in Denmark, Sweden, Finland and Norway may be stamped at the Tax Refund Agency Counter between Terminal 2 and 3 without the need to be stamped by the Customs; Tax Refund Forms issued in EU member states other than these four (4) states must also be stamped at the Customs Counter.

Tax Refund Forms for purchases made in Denmark, Sweden, Finland and Norway may be stamped at the Tax Refund Agency Counter between Terminal 2 and 3 without the need to be stamped by the Customs; Tax Refund Forms issued in EU member states other than these four (4) states must also be stamped at the Customs Counter.

Copenhagen International Airport

Sweden

Sweden

UnionPay Tax Refund Steps:

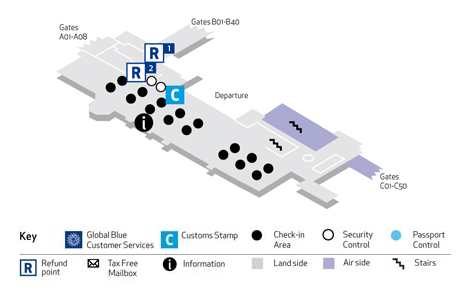

1. Tax refund can be applied for any purchase over 200.00 Swedish krona (about RMB156.38) in a single receipt; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62. (Reference tax free rate: 25% for general goods, 12% for food and 6% for books)

2. Go through the boarding procedure and then present your boarding pass, passport, Tax Refund Form, tax-free goods and sales slip to corresponding tax-free company for examination and tax refunding. If tax-free goods are within the check-in luggage, please inform the airport staff in advance and complete the tax refund procedure before having the luggage checked. Note: Blue Tax Free Forms for purchases made in Denmark, Sweden, Finland and Norway may be stamped at the Global Blue Tax Refund Agency Counter in Terminal 5 without the need to be stamped by the Customs; Tax Refund Forms issued in EU member states other than these four (4) states must also be stamped at the Customs Counter on Terminal 5 Departure level.

3. Post the stamped Tax Refund Form to the counter or mailbox of corresponding tax-free company.

UnionPay Tax Refund Tips:

As Sweden is a member state of EU, tax refund for purchases made in Sweden can be applied for in the last member state before departure from EU. Accordingly, if you are heading for China from Sweden, tax refund for purchases made in other member states within three (3) months can also be applied for in Sweden.

Goods with a VAT rate of 6% are not refundable, ie books cannot be refunded.

Locations of the Customs and Tax-free Counter at Stockholm Arlanda International Airport

Finland

Finland

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 40 Euro in a single receipt; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62. (Reference tax free rate: 24% for general goods, 14% for food; actual tax free rate: 12-16%)

2. When departing from Finland, firstly go through the boarding procedure and then present your boarding pass, passport, Tax Refund Form, tax-free goods and sales slip to corresponding tax-free company or the Customs Office for examination and tax refunding. If tax-free goods are within the check-in luggage, please inform the airport staff in advance and complete the tax refund procedure before having the luggage checked.

Note: Global Blue Tax Free Forms for purchases made in Denmark, Sweden, Finland and Norway may be stamped at the Global Blue Tax Refund Agency Counter near Gate 29 in Helsinki Airport Terminal 2 without the need to be stamped by the Customs; Tax Refund Forms issued in EU member states other than these four (4) states must also be stamped at the Customs Counter.

3. Post the stamped Tax Refund Form together with the sales slip to the counter or mailbox of corresponding tax-free company.

UnionPay Tax Refund Tips:

As Finland is a member state of EU, tax refund for purchases made in Finland can be applied for in the last member state before departure from EU. Accordingly, if you are heading for China from Finland, tax refund for purchases made in other member states within three (3) months can also be applied for in Finland.

Locations of the Customs and Tax Free Counter at Helsinki Airport

Norway

Norway

UnionPay Tax Refund Steps:

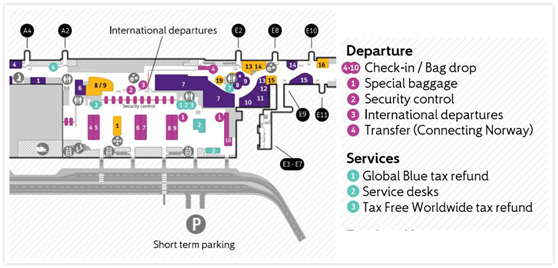

1. Tax refund can be applied for any purchase over 315.00 Norwegian Krone (about RMB 259.00) or over 290.00 Norwegian Krone (about RMB 238.00) in a single receipt; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62. (Reference tax free rate: 25% for general goods, 15% for food; actual tax free rate: 12-16%)

2. When departing from Finland, please present your boarding pass, passport, Tax Refund Form, tax-free goods and sales slip to corresponding tax-free company or the Customs Office for examination and tax refunding before going through the boarding procedure (at Oslo Airport, no tax refund can be applied for after passing the Security Control).

Note:

Global Blue Tax Free Forms for purchases made in Denmark, Sweden, Finland and Norway may be stamped at the Global Blue Tax Refund Agency Counter near the boarding security gate at Oslo Airport without the need to be stamped by the Customs; Tax Refund Forms issued in EU member states other than these four (4) states must also be stamped at the Customs Counter.

3. Post the stamped Tax Refund Form together with the sales slip to the counter or mailbox of corresponding tax-free company.

UnionPay Tax Refund Tips:

As Norway is not an EU member state, you must go through the tax refund procedure before departing from Norway if you are heading for other European regions.

As Norway is not an EU member state, you must go through the tax refund procedure before departing from Norway if you are heading for other European regions.

Please note that you must go through the tax refund procedure within one (1) month after purchase in Norway.

Please note that you must go through the tax refund procedure within one (1) month after purchase in Norway.

Norway does not need to look at the passport and can unpack it when shopping. However, Norway uses a credit card to make a purchase. If the credit card does not have a chip (usually the domestic card is a magnetic stripe), you need to check the passport to check the credit card holder and signature.

Norway does not need to look at the passport and can unpack it when shopping. However, Norway uses a credit card to make a purchase. If the credit card does not have a chip (usually the domestic card is a magnetic stripe), you need to check the passport to check the credit card holder and signature.

Locations of the Customs and Tax Free Counter at Oslo Airport

Iceland

Iceland

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 6,000.00 Icelandic krona (about RMB 350.00) in a single receipt in any of the stores posted with Iceland Tax-Free Shopping logo; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62.

2. When departing from Island, please present your boarding pass, passport, Tax Refund Form, tax-free goods and sales slip to corresponding tax-free company or the Customs Office for examination and tax refunding before going through the boarding procedure.

3. Post the stamped Tax Refund Form together with the sales slip to the counter or mailbox of corresponding tax-free company.

UnionPay Tax Refund Tips:

As Iceland is not an EU member state, you must go through the tax refund procedure before departing from Iceland if you are heading for other European regions.

Keflavik International Airport

Faroe Islands

Faroe Islands

UnionPay Tax Refund Steps:

Tax refund service is available to Non-Faroese residents. The minimum purchase amount for tax refund is 100 Euro per individual receipt.

Purchase date does not exceed 90 days from the date of departure. Theoretically, a tax refund form stamped with a valid customs seal is valid for a year from the date of issuance of the tax refund form.

When leaving the last country in the Eu, please show the sealed and unused goods, tax refund form and shopping receipt to the customs, and ask the customs officer to stamp the tax refund form in the corresponding place.

A tax refund form without customs seal shall be deemed to be invalid. After returning to China, you can apply for tax refund with the tax refund form with customs seal, the original shopping receipt and your personal passport.

Belgium

Belgium

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 50.00 Euro in the same tax-free store on the same day; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62. (Reference tax free rate: 21% for general goods; 6% for food; handling charge will be deducted by the tax-free company)

2. When departing from Island, please present your passport, Tax Refund Form, tax-free goods and sales slip to the Customs Office (Brussels International Airport Customs Office is near International Departure Gate B) for examination and tax refunding before going through the boarding procedure.

3. Post the stamped Tax Refund Form together with the sales slip to the mailbox.

UnionPay Tax Refund Tips:

No tax refund is available for tobacco purchased in Belgium

No tax refund is available for tobacco purchased in Belgium

As Belgium is a member state of EU, tax refund for purchases made in Belgium can be applied for in the last member state before departure from EU. Accordingly, if you are heading for China from Belgium, tax refund for purchases made in other member states can also be applied for in Belgium.

As Belgium is a member state of EU, tax refund for purchases made in Belgium can be applied for in the last member state before departure from EU. Accordingly, if you are heading for China from Belgium, tax refund for purchases made in other member states can also be applied for in Belgium.

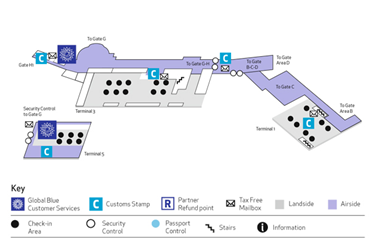

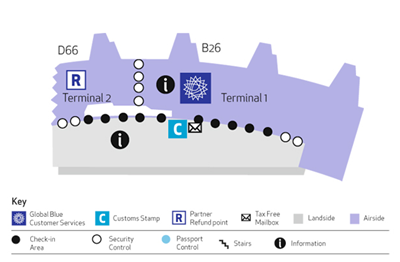

Locations of the Customs and Refund point at Brussels International Airport:

Luxembourg

Luxembourg

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 74.00 Euro; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62. (Reference tax free rate: VAT 15%)

2. When departing from Island, please present your passport, Tax Refund Form, tax-free goods and sales slip to the Customs Office (near Luxembourg-Findel International Airport International Arrival Gate B) for examination and tax refunding before going through the boarding procedure.

3. Post the stamped Tax Refund Form together with the sales slip to the mailbox.

Estonia

Estonia

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 38.01 Euro; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62. (Reference tax free rate: VAT 20%)

2. If tax-free goods are within the check-in luggage, then before going through the boarding procedure, please apply to the Customs Office for tax refund by presenting your Tax Refund Form, passport, tax-free goods and sales slip to the Customs Office (near the entrance to the Arrival level) for inspection and stamping.

If the tax-free goods are within the carry-on luggage, please firstly pass the Security Control and then make a call to the Customs officer via the international telephone between Gate 5 and 7 to handle the tax refund formalities for you.

3. Post the stamped Tax Refund Form together with the sales slip to the mailbox.

UnionPay Tax Refund Tips:

No tax refund is available for books and medicines

No tax refund is available for books and medicines

As Estonia is a member state of EU, tax refund for purchases made in Estonia can be applied for in the last member state before departure from EU. Accordingly, if you are heading for China from Estonia, tax refund for purchases made in other member states can also be applied for in Estonia.

As Estonia is a member state of EU, tax refund for purchases made in Estonia can be applied for in the last member state before departure from EU. Accordingly, if you are heading for China from Estonia, tax refund for purchases made in other member states can also be applied for in Estonia.

Location of the Customs at Lennart Meri Tallinn International Airport:

Latvia

Latvia

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 44 Euro; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62. (Reference tax free rate: 21% for general goods; 12% for medicines, books, medical devices, and baby care products)

2. If tax-free goods are within the check-in luggage, then before going through the boarding procedure, please apply to the Officer of check-in counter for tax refund who will contact Customs Office (near the Departure level) for inspection and stamping. If the tax-free goods are within the carry-on luggage, please firstly pass the Security Control and then contact with themake a call to the Customs officer via the currency exchanges named Eurex Capital which located at the duty free area of the Departure Lobby.

3. Post the stamped Tax Refund Form together with the sales slip to the mailbox.。

UnionPay Tax Refund Tips:

As Latvia is a member state of EU, tax refund for purchases made in Latvia can be applied for in the last member state before departure from EU. Accordingly, if you are heading for China from Latvia, tax refund for purchases made in other member states can also be applied for in Latvia.

Location of the Customs at Riga International Airport

Lithuania(Republic of Lithuania)

Lithuania(Republic of Lithuania)

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 200.00 Lithuanian litas (about RMB 432.60) in designated tax-free stores; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62. (Reference tax free rate: VAT 21%)

2. If tax-free goods are within the check-in luggage, then before going through the boarding procedure, please apply to the Customs Office for tax refund by presenting your Tax Refund Form, passport, tax-free goods and sales slip to the Customs Office (near the Departure Hall) for inspection and stamping.

If the tax-free goods are within the carry-on luggage, please firstly pass the Security Control and then make a call to the Customs officer via the international telephone on the right of the Passport Control to handle the tax refund formalities for you.

3. Post the stamped Tax Refund Form together with the sales slip to the mailbox.

UnionPay Tax Refund Tips:

No tax refund is available for gem, shoe-shaped gold ingot, coins, tobacco products, alcohol products, and fuel.

No tax refund is available for gem, shoe-shaped gold ingot, coins, tobacco products, alcohol products, and fuel.

As Lithuania is a member state of EU, tax refund for purchases made in Lithuania can be applied for in the last member state before departure from EU. Accordingly, if you are heading for China from Lithuania, tax refund for purchases made in other member states can also be applied for in Lithuania.

As Lithuania is a member state of EU, tax refund for purchases made in Lithuania can be applied for in the last member state before departure from EU. Accordingly, if you are heading for China from Lithuania, tax refund for purchases made in other member states can also be applied for in Lithuania.

Location of the Customs Tax-free Counter at Vilnius International Airport

Argentina

Argentina

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 70.00 peso (1 peso≈ RMB 0.44 Yuan); when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card having number starting with 62. (Reference tax free rate: VAT 21%)

2. Before going through the boarding procedure, please find the Customs Office for inspection and have the tax refund form stamped.

3. Post the stamped Tax Refund Form together with the sales slip to the mailbox.

Uruguay

Uruguay

UnionPay Tax Refund Steps:

1. Tax refund can be applied for any purchase over 500.00 peso (about RMB 119.00) in a single receipt; when completing the Tax Refund Form, please choose credit card for receiving tax refund and fill in a UnionPay card number starting with 62. (Reference tax free rate: VAT 21%; tax-free goods include fashion, garment, leather products, shoes, beverages, food, souvenirs, knitting, and craft)

2. Before going through the boarding procedure, please find the Customs Office for inspection and have the tax refund form stamped.

3. Post the stamped Tax Refund Form together with the sales slip to the mailbox.

Bahamas

Bahamas

UnionPay Tax Refund Steps:

1. Upon buying Non-consumables more than $ 25,00, you will receive the refund immediately at the time of your purchase as a deduction from the sale price.

2. Upon buying Consumables e.g. tobacco and alcohol for more than $ 50,00. Or rum cakes for more than $ 25,00, provide the shop staff with your credit card details. The staff in the shop will issue a Tax Free Form for you and explain further details of how to validate it and receive the refund.

UnionPay Tax Refund Tips:

The goods could be put in your personal luggage.

The goods could be put in your personal luggage.